Why Gaming VCs Are Reshaping the Future of Entertainment

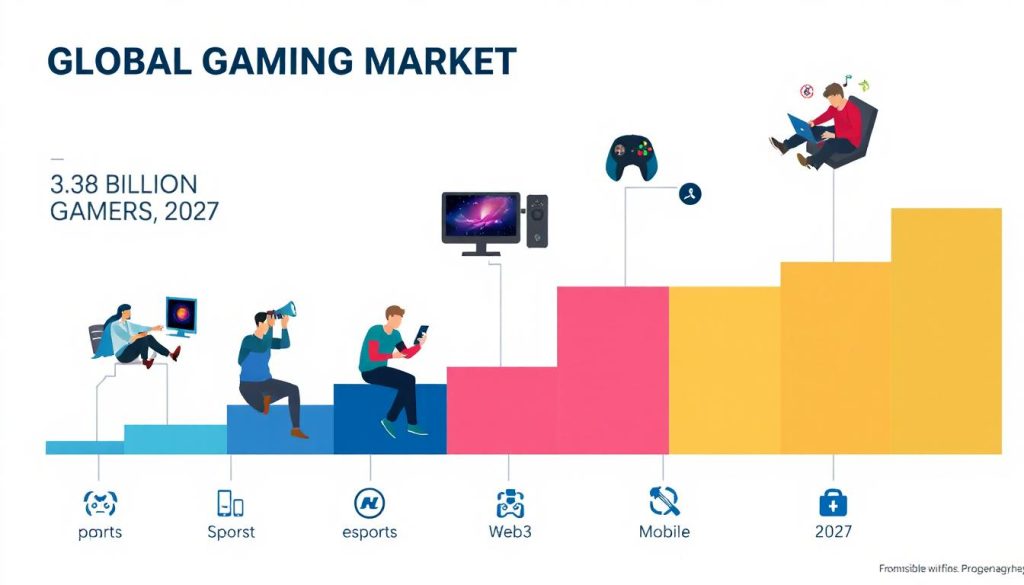

Andreessen Horowitz, Griffin Gaming Partners, and BITKRAFT are leading names driving the surge of venture capital in games. They’re betting billions on the future of gaming. The global gaming market is booming, with over 3.38 billion gamers worldwide and revenues projected to surpass $205 billion by 2027 (Statista, 2024). As venture capital in games continues to surge, investors are increasingly backing startups across esports, Web3, mobile, and immersive game tech.

For those interested in how indie game developers can secure funding, check out our detailed guide on Indie Game Funding: Importance, Methods, and Step-by-Step Guidance. This article dives deep into the top 50 venture capital firms investing heavily in gaming startups, esports, Web3, and gaming infrastructure.

Top 50 Venture Capital Firms Investing in Gaming

Want to fund your game studio or next big gaming platform?

You’re not alone. With over $205B in global gaming revenue and 3.38 billion players worldwide, VCs are betting big on games.

If you’re seeking guidance, don’t miss our full breakdown of strategies in:

👉 Indie Game Funding: Importance, Methods, and Step-by-Step Guidance

Why Gaming Is a VC Magnet

The gaming industry isn’t just entertainment—it’s serious business. In 2023 alone, venture capitalists poured $8.9 billion into game studios, platforms, and infrastructure. Web3, mobile, cloud, and esports are all ripe for innovation.

VCs are now strategic partners who shape product direction, community strategy, and monetization. Their role is more vital than ever.

How This List Was Created

We studied over 100 venture firms globally and ranked them by:

- Size and frequency of investments

- Notable portfolio companies

- Stage focus (Seed, Series A, etc.)

- Region and sector specialty

This list includes a mix of well-known giants and rising stars.

| # | VC Firm | Region | Focus Areas | Website |

| 1 | Andreessen Horowitz (a16z) | USA | Web3, gaming platforms, infra | a16z.com/games |

| 2 | Makers Fund | Global | Core gaming, IP, development tools | makersfund.com |

| 3 | BITKRAFT Ventures | Global | Esports, platforms, blockchain | bitkraft.vc |

| 4 | Griffin Gaming Partners | USA | Games, technology, publishing | griffingp.com |

| 5 | London Venture Partners | Europe | Early-stage gaming startups | londonvp.com |

| 6 | Play Ventures | Singapore | Mobile games, infrastructure | playventures.vc |

| 7 | Galaxy Interactive | USA | Metaverse, blockchain gaming | galaxyinteractive.io |

| 8 | Hiro Capital | UK | Digital sports, VR/AR, gaming | hiro.capital |

| 9 | Transcend Fund | USA | Game development, publishing | transcend.fund |

| 10 | Konvoy Ventures | USA | Game tech infrastructure | konvoy.vc |

| 11 | GameFounders | Europe/Asia | Accelerator for game startups | gamefounders.com |

| 12 | Dune Ventures | USA | Frontier tech, gaming | dune.ventures |

| 13 | SeventySix Capital | USA | Esports, sports technology | seventysixcapital.com |

| 14 | Black Sheep Ventures | USA | Gaming, e-commerce, fintech | blacksheepvc.com |

| 15 | Sisu Game Ventures | Nordics | Indie and early-stage games | sisugameventures.com |

| 16 | MGVC (MY.GAMES) | Europe | Mobile games, studios | mgvc.com |

| 17 | Pollen VC | UK | Mobile game financing | pollen.vc |

| 18 | Colopl Next | Japan | Mobile games, AR/VR | coloplnext.co.jp |

| 19 | 76ers Innovation Lab | USA | Gaming + sports startups | sixersinnovationlab.com |

| 20 | Animoca Brands | Asia | Web3, NFTs, metaverse | animocabrands.com |

| 21 | Makerspace | USA | Indie game studios | makerspace.vc |

| 22 | FTX Ventures | USA | Blockchain gaming | ftx.com/ventures |

| 23 | Founders Fund | USA | Gaming, software | foundersfund.com |

| 24 | Sky9 Capital | China | Mobile and PC games | sky9capital.com |

| 25 | Bit9 Capital | USA | Blockchain, gaming startups | bit9.capital |

| 26 | Makers Fund II | Global | Gaming, IP | makersfund.com |

| 27 | Social Capital | USA | Gaming, AI | socialcapital.com |

| 28 | Greycroft | USA | Consumer tech, gaming | greycroft.com |

| 29 | CapitalG | USA | Growth-stage gaming companies | capitalg.com |

| 30 | Tencent Investment | China | Global gaming | tencent.com |

| 31 | Accel Partners | USA | Early-stage tech and gaming | accel.com |

| 32 | Redpoint Ventures | USA | Gaming, tech | redpoint.com |

| 33 | Canaan Partners | USA | Consumer & gaming tech | canaan.com |

| 34 | Lux Capital | USA | Emerging tech & gaming | luxcapital.com |

| 35 | Bessemer Venture Partners | USA | Consumer internet & gaming | bvp.com |

| 36 | Madrona Venture Group | USA | Gaming and cloud technology | madrona.com |

| 37 | Bitkraft Next | Global | Gaming and metaverse | bitkraft.vc |

| 38 | Northzone | Europe | Early-stage gaming | northzone.com |

| 39 | Raptor Group | USA | Gaming, esports, blockchain | raptorgroup.com |

| 40 | Lightspeed Venture Partners | USA | Gaming and tech startups | lsvp.com |

| 41 | SoftBank Vision Fund | Japan | Gaming and tech giants | visionfund.com |

| 42 | Makers Fund III | Global | Diverse gaming portfolios | makersfund.com |

| 43 | Revolution Growth | USA | Consumer and gaming startups | revolution.com |

| 44 | Upfront Ventures | USA | Gaming, SaaS | upfront.com |

| 45 | Thrive Capital | USA | Consumer and gaming startups | thrivecap.com |

| 46 | Balderton Capital | Europe | Gaming and consumer tech | balderton.com |

| 47 | Lightspeed India Partners | India | Gaming startups in Asia | lightspeedindia.com |

| 48 | Digital Currency Group | USA | Blockchain and gaming | dcg.co |

| 49 | Mythical Games | USA | Blockchain gaming | mythical.games |

| 50 | Play Ventures II | Singapore | Mobile games, tools, infra | playventures.vc |

Case Studies and Market Impact

Andreessen Horowitz (a16z)

One of the largest and most influential VC firms globally, a16z has invested over $1 billion in gaming and Web3 startups since 2020. Their portfolio includes Sky Mavis (Axie Infinity), which revolutionized blockchain gaming by attracting over 2 million daily active users at its peak (Crunchbase, 2023).

BITKRAFT Ventures

Focusing on esports and interactive media, BITKRAFT led a $20 million funding round for FaZe Clan, one of the most successful esports organizations worldwide. Their support helped FaZe diversify into content creation and gaming merchandise, expanding their valuation above $1 billion (Forbes, 2022).

Why Investors Should Consider Gaming VC Firms

- Growing Market: The gaming industry’s size and growth rate outpace many other tech sectors.

- Diverse Opportunities: From mobile games to esports, metaverse, and blockchain gaming, VCs can diversify portfolios.

- Innovation Driver: VCs fund innovation that reshapes entertainment, social interaction, and technology.

Final Thoughts

The listed 50 venture capital firms are shaping the future of gaming. Whether you are a startup founder or an investor, understanding these firms’ focus and investment strategies can help you navigate the dynamic gaming ecosystem.

For a comprehensive guide on funding strategies specifically for indie developers, don’t miss our article on Indie Game Funding: Importance, Methods, and Step-by-Step Guidance.