Have you ever wondered why investors with a high risk profile should invest in the game industry? It’s a question that my colleague and I recently discussed when considering a new project. As a game developer, studio owner, or investor, I’m sure you may have asked yourself the same question.

Unfortunately, there’s no easy answer to this question, but we can look at data and statistics to gain some insights. Base on a Drake star Global Gaming Report 2023, With $86B in disclosed value for closed deals, 2023 was a record year for gaming from a deal value standpoint, mainly due to the much-awaited closing of Microsoft’s acquisition of Activision in Q4’23. Overall, 2023 was a robust year with $20B in disclosed value of announced deals. Q4’23 saw a notable pickup in M&A deals compared to Q3,

Interestingly, many big companies have invested in studios and taken on this risk. In this article, in addition to examining the risks, we examine one of the big companies that invested in this field last year.

-

- The most active VCs in early to late stage included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming while the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Global Gaming Report 2023

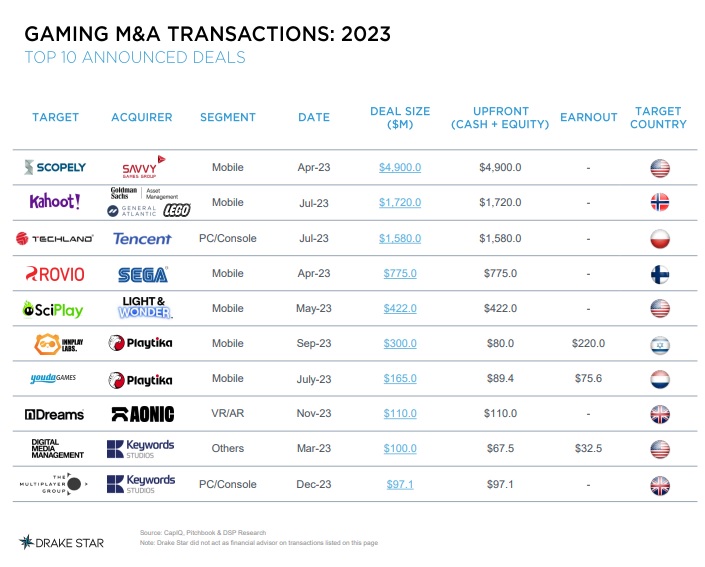

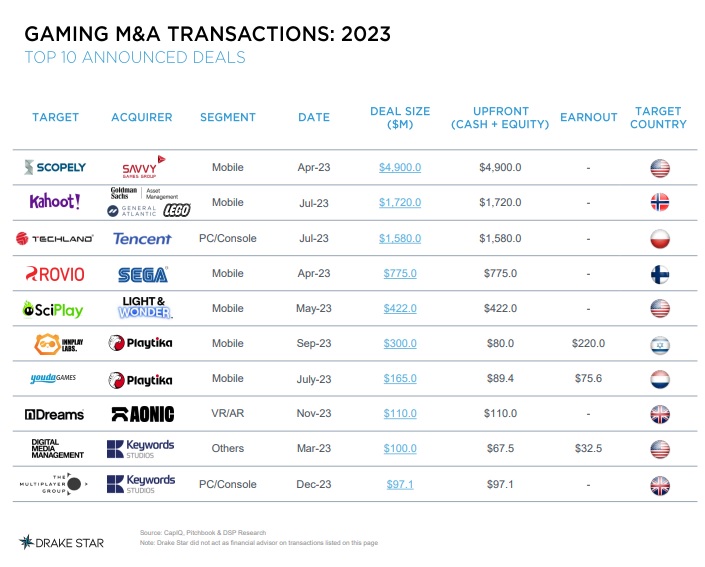

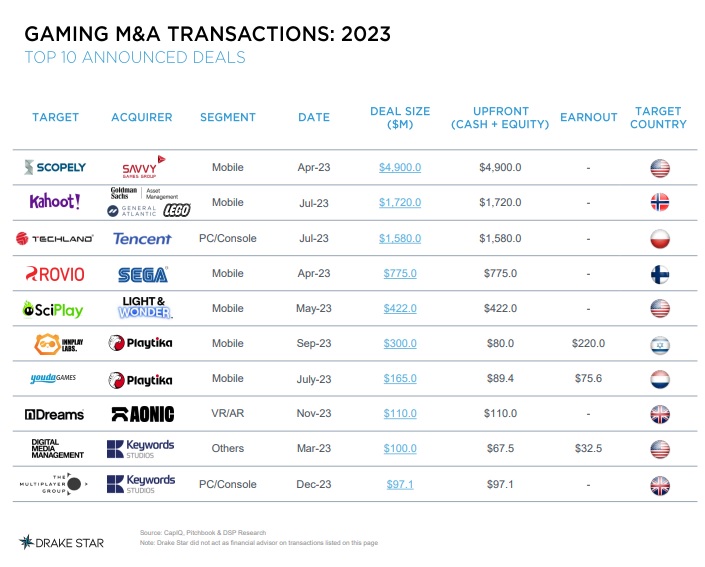

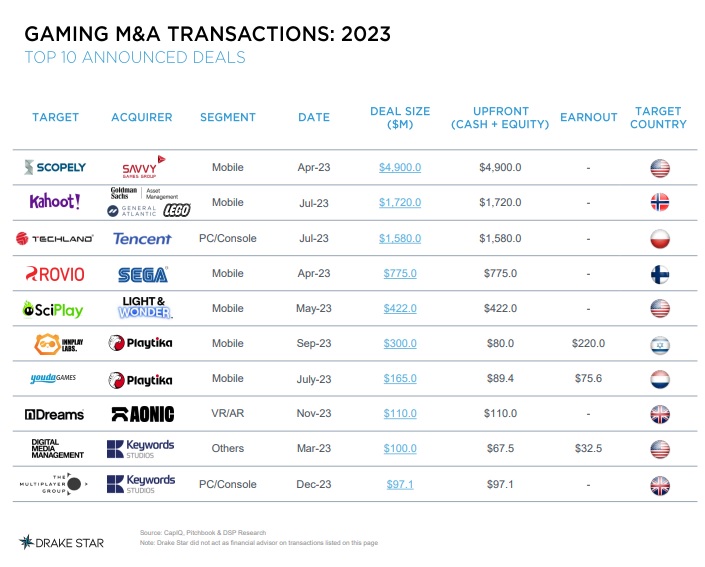

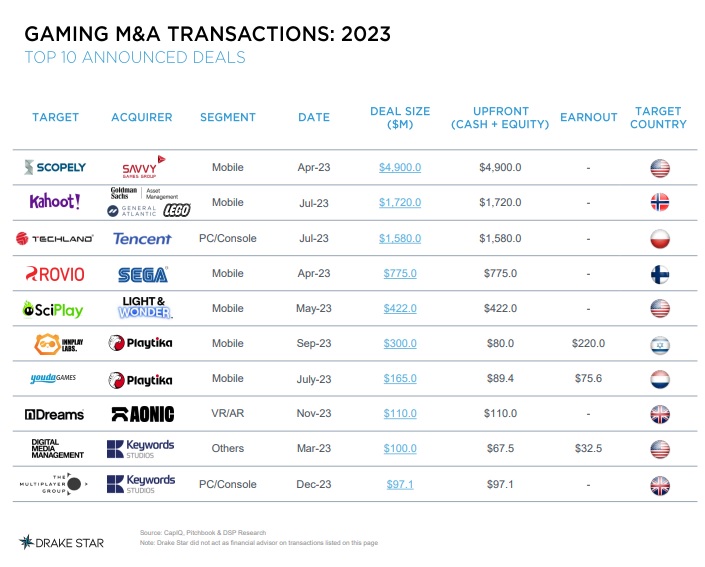

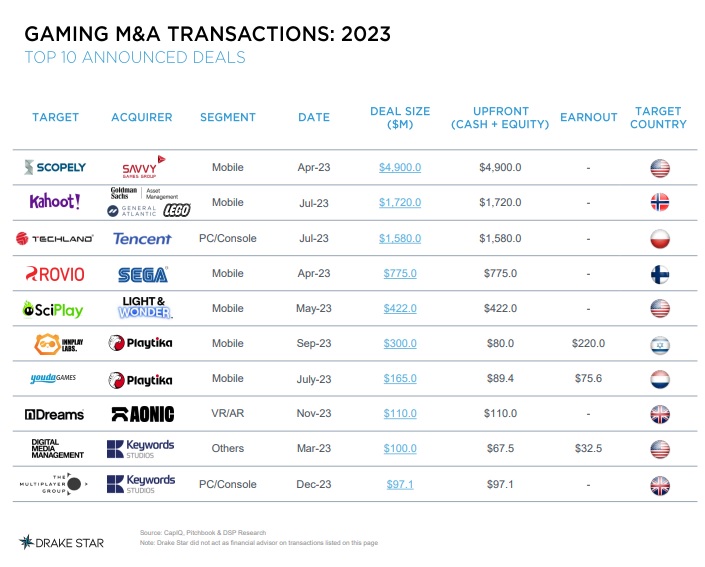

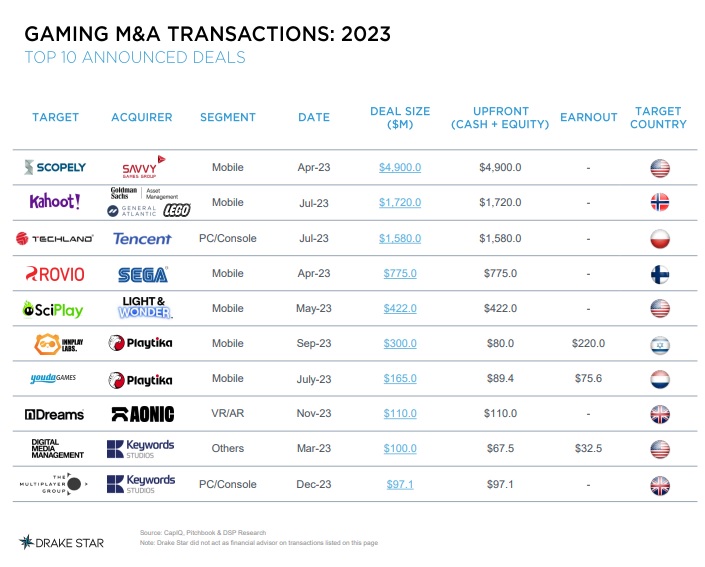

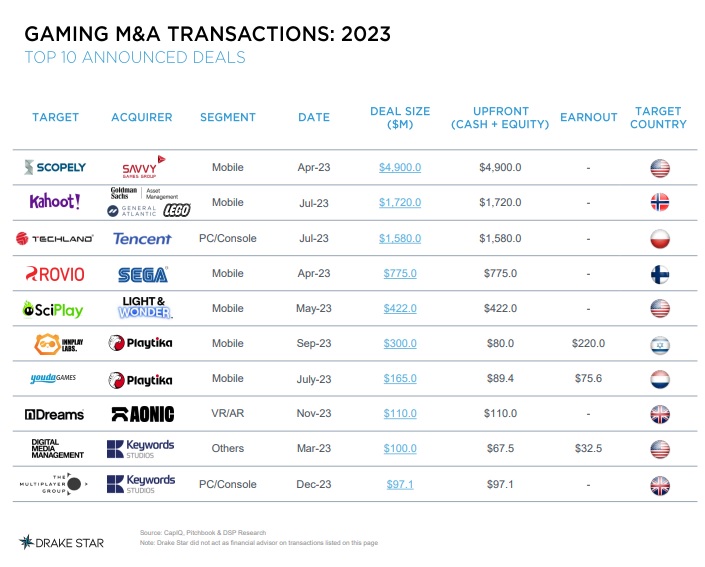

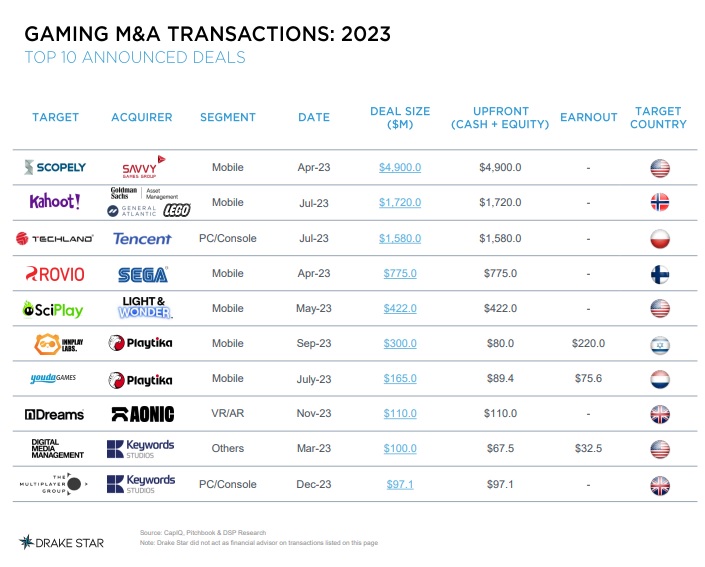

- TOP 10 ANNOUNCEDDEALS

Microsoft Goes on a Studio Spree: How Acquisitions are Shaping the Future of Gaming

The gaming industry is witnessing a power shift, orchestrated by none other than Microsoft. Their recent acquisition spree, targeting studios like Zenimax Media (Bethesda) and Double Fine, signifies a bold new strategy with far-reaching implications for the future of gaming. Let’s delve into the why and how of this exciting development.

The Power of Game Pass:

Microsoft’s Game Pass subscription service has become a game-changer. Offering access to a vast library of titles for a monthly fee, it’s revolutionizing how players access and discover games. Acquiring studios like Bethesda bolsters this library with iconic franchises like Fallout, Elder Scrolls, and Doom, instantly making Game Pass even more attractive.

More Than Just Games:

But it’s not just about adding popular titles. Microsoft is acquiring studios with proven talent and creative vision. Double Fine, known for quirky yet critically acclaimed games like Psychonauts, brings a unique voice and development expertise to the table. These acquisitions strengthen Microsoft’s internal development capabilities, allowing them to diversify their offerings and cater to a wider range of player preferences.

Building an Ecosystem:

Microsoft isn’t just acquiring studios; they’re building an ecosystem. By bringing together diverse talents and franchises under one roof, they create a synergy that benefits both developers and players. Imagine playing a new Double Fine game with the technical prowess of Microsoft studios, or exploring a post-apocalyptic wasteland in Fallout with the innovative gameplay mechanics of a smaller studio. The possibilities are exciting.

The Competitive Landscape:

Microsoft’s move isn’t happening in a vacuum. Sony, their main competitor, also boasts a strong lineup of first-party studios and successful exclusives. This acquisition spree can be seen as a strategic response, aiming to solidify Microsoft’s position in the ongoing console war.

What Does it Mean for Gamers?

For gamers, this means more choices, diverse experiences, and potentially better value. More games could find their way onto Game Pass, offering greater affordability and accessibility. However, concerns about platform exclusivity and homogenization of game design also arise. It’s a complex landscape with both opportunities and challenges for the future.

The Game Isn’t Over:

Microsoft’s studio acquisitions are just one chapter in the evolving story of gaming. It’s a move with clear strategic intent, but the ultimate impact remains to be seen. How these studios integrate, what new games they create, and how the competitive landscape changes are questions that will unfold in the coming years. One thing is certain: the game industry is entering a new era, and Microsoft’s bold moves are putting them at the forefront of this exciting transformation.

-

- Over $3.5B was raised in 750+ financing rounds of private companies, comparable to the $3.4B raised in 2020 (excluding the large Epic Games deal).

- Mobile was the most active segment (168), followed by blockchain (159) and platform/tools (143). Top financings were VSPO ($265M), Candivore ($100M) and Second Dinner ($100M).

-

- The most active VCs in early to late stage included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming while the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Global Gaming Report 2023

- TOP 10 ANNOUNCEDDEALS

Microsoft Goes on a Studio Spree: How Acquisitions are Shaping the Future of Gaming

The gaming industry is witnessing a power shift, orchestrated by none other than Microsoft. Their recent acquisition spree, targeting studios like Zenimax Media (Bethesda) and Double Fine, signifies a bold new strategy with far-reaching implications for the future of gaming. Let’s delve into the why and how of this exciting development.

The Power of Game Pass:

Microsoft’s Game Pass subscription service has become a game-changer. Offering access to a vast library of titles for a monthly fee, it’s revolutionizing how players access and discover games. Acquiring studios like Bethesda bolsters this library with iconic franchises like Fallout, Elder Scrolls, and Doom, instantly making Game Pass even more attractive.

More Than Just Games:

But it’s not just about adding popular titles. Microsoft is acquiring studios with proven talent and creative vision. Double Fine, known for quirky yet critically acclaimed games like Psychonauts, brings a unique voice and development expertise to the table. These acquisitions strengthen Microsoft’s internal development capabilities, allowing them to diversify their offerings and cater to a wider range of player preferences.

Building an Ecosystem:

Microsoft isn’t just acquiring studios; they’re building an ecosystem. By bringing together diverse talents and franchises under one roof, they create a synergy that benefits both developers and players. Imagine playing a new Double Fine game with the technical prowess of Microsoft studios, or exploring a post-apocalyptic wasteland in Fallout with the innovative gameplay mechanics of a smaller studio. The possibilities are exciting.

The Competitive Landscape:

Microsoft’s move isn’t happening in a vacuum. Sony, their main competitor, also boasts a strong lineup of first-party studios and successful exclusives. This acquisition spree can be seen as a strategic response, aiming to solidify Microsoft’s position in the ongoing console war.

What Does it Mean for Gamers?

For gamers, this means more choices, diverse experiences, and potentially better value. More games could find their way onto Game Pass, offering greater affordability and accessibility. However, concerns about platform exclusivity and homogenization of game design also arise. It’s a complex landscape with both opportunities and challenges for the future.

The Game Isn’t Over:

Microsoft’s studio acquisitions are just one chapter in the evolving story of gaming. It’s a move with clear strategic intent, but the ultimate impact remains to be seen. How these studios integrate, what new games they create, and how the competitive landscape changes are questions that will unfold in the coming years. One thing is certain: the game industry is entering a new era, and Microsoft’s bold moves are putting them at the forefront of this exciting transformation.

[/vc_column_text][/vc_column]

-

- Over $3.5B was raised in 750+ financing rounds of private companies, comparable to the $3.4B raised in 2020 (excluding the large Epic Games deal).

- Mobile was the most active segment (168), followed by blockchain (159) and platform/tools (143). Top financings were VSPO ($265M), Candivore ($100M) and Second Dinner ($100M).

-

- The most active VCs in early to late stage included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming while the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Global Gaming Report 2023

- TOP 10 ANNOUNCEDDEALS

Microsoft Goes on a Studio Spree: How Acquisitions are Shaping the Future of Gaming

The gaming industry is witnessing a power shift, orchestrated by none other than Microsoft. Their recent acquisition spree, targeting studios like Zenimax Media (Bethesda) and Double Fine, signifies a bold new strategy with far-reaching implications for the future of gaming. Let’s delve into the why and how of this exciting development.

The Power of Game Pass:

Microsoft’s Game Pass subscription service has become a game-changer. Offering access to a vast library of titles for a monthly fee, it’s revolutionizing how players access and discover games. Acquiring studios like Bethesda bolsters this library with iconic franchises like Fallout, Elder Scrolls, and Doom, instantly making Game Pass even more attractive.

More Than Just Games:

But it’s not just about adding popular titles. Microsoft is acquiring studios with proven talent and creative vision. Double Fine, known for quirky yet critically acclaimed games like Psychonauts, brings a unique voice and development expertise to the table. These acquisitions strengthen Microsoft’s internal development capabilities, allowing them to diversify their offerings and cater to a wider range of player preferences.

Building an Ecosystem:

Microsoft isn’t just acquiring studios; they’re building an ecosystem. By bringing together diverse talents and franchises under one roof, they create a synergy that benefits both developers and players. Imagine playing a new Double Fine game with the technical prowess of Microsoft studios, or exploring a post-apocalyptic wasteland in Fallout with the innovative gameplay mechanics of a smaller studio. The possibilities are exciting.

The Competitive Landscape:

Microsoft’s move isn’t happening in a vacuum. Sony, their main competitor, also boasts a strong lineup of first-party studios and successful exclusives. This acquisition spree can be seen as a strategic response, aiming to solidify Microsoft’s position in the ongoing console war.

What Does it Mean for Gamers?

For gamers, this means more choices, diverse experiences, and potentially better value. More games could find their way onto Game Pass, offering greater affordability and accessibility. However, concerns about platform exclusivity and homogenization of game design also arise. It’s a complex landscape with both opportunities and challenges for the future.

The Game Isn’t Over:

Microsoft’s studio acquisitions are just one chapter in the evolving story of gaming. It’s a move with clear strategic intent, but the ultimate impact remains to be seen. How these studios integrate, what new games they create, and how the competitive landscape changes are questions that will unfold in the coming years. One thing is certain: the game industry is entering a new era, and Microsoft’s bold moves are putting them at the forefront of this exciting transformation.

[/vc_column_text][/vc_column]

-

- A record $86B in disclosed value for closed deals and over $20B in 960 announced deals during 2023.

- 163 M&A deals were announced during 2023 with over $10.5B in disclosed deal value.

- Savvy Games Group/PIF’s acquisition of Scopely for $4.9B led the chart and Kahoot’s acquisition by Goldman Sachs consortium ($1.7B) and Techland’s majority acquisition by Tencent ($1.6B) were the only other $B+ deals during the year.

-

- Over $3.5B was raised in 750+ financing rounds of private companies, comparable to the $3.4B raised in 2020 (excluding the large Epic Games deal).

- Mobile was the most active segment (168), followed by blockchain (159) and platform/tools (143). Top financings were VSPO ($265M), Candivore ($100M) and Second Dinner ($100M).

-

- The most active VCs in early to late stage included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming while the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Global Gaming Report 2023

- TOP 10 ANNOUNCEDDEALS

Microsoft Goes on a Studio Spree: How Acquisitions are Shaping the Future of Gaming

The gaming industry is witnessing a power shift, orchestrated by none other than Microsoft. Their recent acquisition spree, targeting studios like Zenimax Media (Bethesda) and Double Fine, signifies a bold new strategy with far-reaching implications for the future of gaming. Let’s delve into the why and how of this exciting development.

The Power of Game Pass:

Microsoft’s Game Pass subscription service has become a game-changer. Offering access to a vast library of titles for a monthly fee, it’s revolutionizing how players access and discover games. Acquiring studios like Bethesda bolsters this library with iconic franchises like Fallout, Elder Scrolls, and Doom, instantly making Game Pass even more attractive.

More Than Just Games:

But it’s not just about adding popular titles. Microsoft is acquiring studios with proven talent and creative vision. Double Fine, known for quirky yet critically acclaimed games like Psychonauts, brings a unique voice and development expertise to the table. These acquisitions strengthen Microsoft’s internal development capabilities, allowing them to diversify their offerings and cater to a wider range of player preferences.

Building an Ecosystem:

Microsoft isn’t just acquiring studios; they’re building an ecosystem. By bringing together diverse talents and franchises under one roof, they create a synergy that benefits both developers and players. Imagine playing a new Double Fine game with the technical prowess of Microsoft studios, or exploring a post-apocalyptic wasteland in Fallout with the innovative gameplay mechanics of a smaller studio. The possibilities are exciting.

The Competitive Landscape:

Microsoft’s move isn’t happening in a vacuum. Sony, their main competitor, also boasts a strong lineup of first-party studios and successful exclusives. This acquisition spree can be seen as a strategic response, aiming to solidify Microsoft’s position in the ongoing console war.

What Does it Mean for Gamers?

For gamers, this means more choices, diverse experiences, and potentially better value. More games could find their way onto Game Pass, offering greater affordability and accessibility. However, concerns about platform exclusivity and homogenization of game design also arise. It’s a complex landscape with both opportunities and challenges for the future.

The Game Isn’t Over:

Microsoft’s studio acquisitions are just one chapter in the evolving story of gaming. It’s a move with clear strategic intent, but the ultimate impact remains to be seen. How these studios integrate, what new games they create, and how the competitive landscape changes are questions that will unfold in the coming years. One thing is certain: the game industry is entering a new era, and Microsoft’s bold moves are putting them at the forefront of this exciting transformation.

[/vc_column_text][/vc_column]

Global Gaming Report 2023:

-

- A record $86B in disclosed value for closed deals and over $20B in 960 announced deals during 2023.

- 163 M&A deals were announced during 2023 with over $10.5B in disclosed deal value.

- Savvy Games Group/PIF’s acquisition of Scopely for $4.9B led the chart and Kahoot’s acquisition by Goldman Sachs consortium ($1.7B) and Techland’s majority acquisition by Tencent ($1.6B) were the only other $B+ deals during the year.

-

- Over $3.5B was raised in 750+ financing rounds of private companies, comparable to the $3.4B raised in 2020 (excluding the large Epic Games deal).

- Mobile was the most active segment (168), followed by blockchain (159) and platform/tools (143). Top financings were VSPO ($265M), Candivore ($100M) and Second Dinner ($100M).

-

- The most active VCs in early to late stage included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming while the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Global Gaming Report 2023

- TOP 10 ANNOUNCEDDEALS

Microsoft Goes on a Studio Spree: How Acquisitions are Shaping the Future of Gaming

The gaming industry is witnessing a power shift, orchestrated by none other than Microsoft. Their recent acquisition spree, targeting studios like Zenimax Media (Bethesda) and Double Fine, signifies a bold new strategy with far-reaching implications for the future of gaming. Let’s delve into the why and how of this exciting development.

The Power of Game Pass:

Microsoft’s Game Pass subscription service has become a game-changer. Offering access to a vast library of titles for a monthly fee, it’s revolutionizing how players access and discover games. Acquiring studios like Bethesda bolsters this library with iconic franchises like Fallout, Elder Scrolls, and Doom, instantly making Game Pass even more attractive.

More Than Just Games:

But it’s not just about adding popular titles. Microsoft is acquiring studios with proven talent and creative vision. Double Fine, known for quirky yet critically acclaimed games like Psychonauts, brings a unique voice and development expertise to the table. These acquisitions strengthen Microsoft’s internal development capabilities, allowing them to diversify their offerings and cater to a wider range of player preferences.

Building an Ecosystem:

Microsoft isn’t just acquiring studios; they’re building an ecosystem. By bringing together diverse talents and franchises under one roof, they create a synergy that benefits both developers and players. Imagine playing a new Double Fine game with the technical prowess of Microsoft studios, or exploring a post-apocalyptic wasteland in Fallout with the innovative gameplay mechanics of a smaller studio. The possibilities are exciting.

The Competitive Landscape:

Microsoft’s move isn’t happening in a vacuum. Sony, their main competitor, also boasts a strong lineup of first-party studios and successful exclusives. This acquisition spree can be seen as a strategic response, aiming to solidify Microsoft’s position in the ongoing console war.

What Does it Mean for Gamers?

For gamers, this means more choices, diverse experiences, and potentially better value. More games could find their way onto Game Pass, offering greater affordability and accessibility. However, concerns about platform exclusivity and homogenization of game design also arise. It’s a complex landscape with both opportunities and challenges for the future.

The Game Isn’t Over:

Microsoft’s studio acquisitions are just one chapter in the evolving story of gaming. It’s a move with clear strategic intent, but the ultimate impact remains to be seen. How these studios integrate, what new games they create, and how the competitive landscape changes are questions that will unfold in the coming years. One thing is certain: the game industry is entering a new era, and Microsoft’s bold moves are putting them at the forefront of this exciting transformation.

[/vc_column_text][/vc_column]

Potential Examples of PC-First/Cross-Platform Projects:

-

- Indie success stories like Hades and Stardew Valley, initially launched on PC, later finding success on consoles. This demonstrates the potential for PC-first titles to reach a wider audience.

- AAA titles like Death Stranding and Horizon Zero Dawn receiving PC ports following their initial PlayStation debuts. This shows developers recognizing the growing PC market and adapting their release strategies.

- Games leveraging cloud streaming services like Google Stadia or GeForce Now to offer cross-platform accessibility. This technology allows developers to target more devices without significant porting burdens.

Global Gaming Report 2023:

-

- A record $86B in disclosed value for closed deals and over $20B in 960 announced deals during 2023.

- 163 M&A deals were announced during 2023 with over $10.5B in disclosed deal value.

- Savvy Games Group/PIF’s acquisition of Scopely for $4.9B led the chart and Kahoot’s acquisition by Goldman Sachs consortium ($1.7B) and Techland’s majority acquisition by Tencent ($1.6B) were the only other $B+ deals during the year.

-

- Over $3.5B was raised in 750+ financing rounds of private companies, comparable to the $3.4B raised in 2020 (excluding the large Epic Games deal).

- Mobile was the most active segment (168), followed by blockchain (159) and platform/tools (143). Top financings were VSPO ($265M), Candivore ($100M) and Second Dinner ($100M).

-

- The most active VCs in early to late stage included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming while the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Global Gaming Report 2023

- TOP 10 ANNOUNCEDDEALS

Microsoft Goes on a Studio Spree: How Acquisitions are Shaping the Future of Gaming

The gaming industry is witnessing a power shift, orchestrated by none other than Microsoft. Their recent acquisition spree, targeting studios like Zenimax Media (Bethesda) and Double Fine, signifies a bold new strategy with far-reaching implications for the future of gaming. Let’s delve into the why and how of this exciting development.

The Power of Game Pass:

Microsoft’s Game Pass subscription service has become a game-changer. Offering access to a vast library of titles for a monthly fee, it’s revolutionizing how players access and discover games. Acquiring studios like Bethesda bolsters this library with iconic franchises like Fallout, Elder Scrolls, and Doom, instantly making Game Pass even more attractive.

More Than Just Games:

But it’s not just about adding popular titles. Microsoft is acquiring studios with proven talent and creative vision. Double Fine, known for quirky yet critically acclaimed games like Psychonauts, brings a unique voice and development expertise to the table. These acquisitions strengthen Microsoft’s internal development capabilities, allowing them to diversify their offerings and cater to a wider range of player preferences.

Building an Ecosystem:

Microsoft isn’t just acquiring studios; they’re building an ecosystem. By bringing together diverse talents and franchises under one roof, they create a synergy that benefits both developers and players. Imagine playing a new Double Fine game with the technical prowess of Microsoft studios, or exploring a post-apocalyptic wasteland in Fallout with the innovative gameplay mechanics of a smaller studio. The possibilities are exciting.

The Competitive Landscape:

Microsoft’s move isn’t happening in a vacuum. Sony, their main competitor, also boasts a strong lineup of first-party studios and successful exclusives. This acquisition spree can be seen as a strategic response, aiming to solidify Microsoft’s position in the ongoing console war.

What Does it Mean for Gamers?

For gamers, this means more choices, diverse experiences, and potentially better value. More games could find their way onto Game Pass, offering greater affordability and accessibility. However, concerns about platform exclusivity and homogenization of game design also arise. It’s a complex landscape with both opportunities and challenges for the future.

The Game Isn’t Over:

Microsoft’s studio acquisitions are just one chapter in the evolving story of gaming. It’s a move with clear strategic intent, but the ultimate impact remains to be seen. How these studios integrate, what new games they create, and how the competitive landscape changes are questions that will unfold in the coming years. One thing is certain: the game industry is entering a new era, and Microsoft’s bold moves are putting them at the forefront of this exciting transformation.

[/vc_column_text][/vc_column]

Potential Examples of Increased M&A Activity:

-

- Microsoft acquiring smaller studios like Zenimax Media (parent company of Bethesda) and Double Fine. These acquisitions bolstered Microsoft’s Game Pass library and development capabilities.

- Sony Interactive Entertainment investing in Haven Studios, a new studio established by industry veterans. This strategic partnership expands Sony’s first-party development potential.

- Embracer Group, known for acquiring numerous studios, continuing its trend in 2024. While specific targets are unknown, they could be smaller studios with valuable intellectual property or specific development expertise.

Read Better:

Venture Capital Investment in the Gaming Industry: Who’s Investing and At What Stage?

Navigating the Challenge of High Development Costs in the Gaming Industry

Potential Examples of PC-First/Cross-Platform Projects:

-

- Indie success stories like Hades and Stardew Valley, initially launched on PC, later finding success on consoles. This demonstrates the potential for PC-first titles to reach a wider audience.

- AAA titles like Death Stranding and Horizon Zero Dawn receiving PC ports following their initial PlayStation debuts. This shows developers recognizing the growing PC market and adapting their release strategies.

- Games leveraging cloud streaming services like Google Stadia or GeForce Now to offer cross-platform accessibility. This technology allows developers to target more devices without significant porting burdens.

Global Gaming Report 2023:

-

- A record $86B in disclosed value for closed deals and over $20B in 960 announced deals during 2023.

- 163 M&A deals were announced during 2023 with over $10.5B in disclosed deal value.

- Savvy Games Group/PIF’s acquisition of Scopely for $4.9B led the chart and Kahoot’s acquisition by Goldman Sachs consortium ($1.7B) and Techland’s majority acquisition by Tencent ($1.6B) were the only other $B+ deals during the year.

-

- Over $3.5B was raised in 750+ financing rounds of private companies, comparable to the $3.4B raised in 2020 (excluding the large Epic Games deal).

- Mobile was the most active segment (168), followed by blockchain (159) and platform/tools (143). Top financings were VSPO ($265M), Candivore ($100M) and Second Dinner ($100M).

-

- The most active VCs in early to late stage included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming while the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Global Gaming Report 2023

- TOP 10 ANNOUNCEDDEALS

Microsoft Goes on a Studio Spree: How Acquisitions are Shaping the Future of Gaming

The gaming industry is witnessing a power shift, orchestrated by none other than Microsoft. Their recent acquisition spree, targeting studios like Zenimax Media (Bethesda) and Double Fine, signifies a bold new strategy with far-reaching implications for the future of gaming. Let’s delve into the why and how of this exciting development.

The Power of Game Pass:

Microsoft’s Game Pass subscription service has become a game-changer. Offering access to a vast library of titles for a monthly fee, it’s revolutionizing how players access and discover games. Acquiring studios like Bethesda bolsters this library with iconic franchises like Fallout, Elder Scrolls, and Doom, instantly making Game Pass even more attractive.

More Than Just Games:

But it’s not just about adding popular titles. Microsoft is acquiring studios with proven talent and creative vision. Double Fine, known for quirky yet critically acclaimed games like Psychonauts, brings a unique voice and development expertise to the table. These acquisitions strengthen Microsoft’s internal development capabilities, allowing them to diversify their offerings and cater to a wider range of player preferences.

Building an Ecosystem:

Microsoft isn’t just acquiring studios; they’re building an ecosystem. By bringing together diverse talents and franchises under one roof, they create a synergy that benefits both developers and players. Imagine playing a new Double Fine game with the technical prowess of Microsoft studios, or exploring a post-apocalyptic wasteland in Fallout with the innovative gameplay mechanics of a smaller studio. The possibilities are exciting.

The Competitive Landscape:

Microsoft’s move isn’t happening in a vacuum. Sony, their main competitor, also boasts a strong lineup of first-party studios and successful exclusives. This acquisition spree can be seen as a strategic response, aiming to solidify Microsoft’s position in the ongoing console war.

What Does it Mean for Gamers?

For gamers, this means more choices, diverse experiences, and potentially better value. More games could find their way onto Game Pass, offering greater affordability and accessibility. However, concerns about platform exclusivity and homogenization of game design also arise. It’s a complex landscape with both opportunities and challenges for the future.

The Game Isn’t Over:

Microsoft’s studio acquisitions are just one chapter in the evolving story of gaming. It’s a move with clear strategic intent, but the ultimate impact remains to be seen. How these studios integrate, what new games they create, and how the competitive landscape changes are questions that will unfold in the coming years. One thing is certain: the game industry is entering a new era, and Microsoft’s bold moves are putting them at the forefront of this exciting transformation.

[/vc_column_text][/vc_column]

Challenges:

-

- High Risk, Low Success Rate: Many indie studios fail, making returns uncertain.

- Long Development Times: Waiting years for a potential return hinders investor patience.

- Limited Data & Transparency: Assessing indie studios’ potential can be difficult.

- Competition: Crowded market with established players and other indies vying for attention.

- Funding Gaps: Securing enough funding for development and marketing is tough.

Potential Examples of Increased M&A Activity:

-

- Microsoft acquiring smaller studios like Zenimax Media (parent company of Bethesda) and Double Fine. These acquisitions bolstered Microsoft’s Game Pass library and development capabilities.

- Sony Interactive Entertainment investing in Haven Studios, a new studio established by industry veterans. This strategic partnership expands Sony’s first-party development potential.

- Embracer Group, known for acquiring numerous studios, continuing its trend in 2024. While specific targets are unknown, they could be smaller studios with valuable intellectual property or specific development expertise.

Read Better:

Venture Capital Investment in the Gaming Industry: Who’s Investing and At What Stage?

Navigating the Challenge of High Development Costs in the Gaming Industry

Potential Examples of PC-First/Cross-Platform Projects:

-

- Indie success stories like Hades and Stardew Valley, initially launched on PC, later finding success on consoles. This demonstrates the potential for PC-first titles to reach a wider audience.

- AAA titles like Death Stranding and Horizon Zero Dawn receiving PC ports following their initial PlayStation debuts. This shows developers recognizing the growing PC market and adapting their release strategies.

- Games leveraging cloud streaming services like Google Stadia or GeForce Now to offer cross-platform accessibility. This technology allows developers to target more devices without significant porting burdens.

Global Gaming Report 2023:

-

- A record $86B in disclosed value for closed deals and over $20B in 960 announced deals during 2023.

- 163 M&A deals were announced during 2023 with over $10.5B in disclosed deal value.

- Savvy Games Group/PIF’s acquisition of Scopely for $4.9B led the chart and Kahoot’s acquisition by Goldman Sachs consortium ($1.7B) and Techland’s majority acquisition by Tencent ($1.6B) were the only other $B+ deals during the year.

-

- Over $3.5B was raised in 750+ financing rounds of private companies, comparable to the $3.4B raised in 2020 (excluding the large Epic Games deal).

- Mobile was the most active segment (168), followed by blockchain (159) and platform/tools (143). Top financings were VSPO ($265M), Candivore ($100M) and Second Dinner ($100M).

-

- The most active VCs in early to late stage included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming while the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Global Gaming Report 2023

- TOP 10 ANNOUNCEDDEALS

Microsoft Goes on a Studio Spree: How Acquisitions are Shaping the Future of Gaming

The gaming industry is witnessing a power shift, orchestrated by none other than Microsoft. Their recent acquisition spree, targeting studios like Zenimax Media (Bethesda) and Double Fine, signifies a bold new strategy with far-reaching implications for the future of gaming. Let’s delve into the why and how of this exciting development.

The Power of Game Pass:

Microsoft’s Game Pass subscription service has become a game-changer. Offering access to a vast library of titles for a monthly fee, it’s revolutionizing how players access and discover games. Acquiring studios like Bethesda bolsters this library with iconic franchises like Fallout, Elder Scrolls, and Doom, instantly making Game Pass even more attractive.

More Than Just Games:

But it’s not just about adding popular titles. Microsoft is acquiring studios with proven talent and creative vision. Double Fine, known for quirky yet critically acclaimed games like Psychonauts, brings a unique voice and development expertise to the table. These acquisitions strengthen Microsoft’s internal development capabilities, allowing them to diversify their offerings and cater to a wider range of player preferences.

Building an Ecosystem:

Microsoft isn’t just acquiring studios; they’re building an ecosystem. By bringing together diverse talents and franchises under one roof, they create a synergy that benefits both developers and players. Imagine playing a new Double Fine game with the technical prowess of Microsoft studios, or exploring a post-apocalyptic wasteland in Fallout with the innovative gameplay mechanics of a smaller studio. The possibilities are exciting.

The Competitive Landscape:

Microsoft’s move isn’t happening in a vacuum. Sony, their main competitor, also boasts a strong lineup of first-party studios and successful exclusives. This acquisition spree can be seen as a strategic response, aiming to solidify Microsoft’s position in the ongoing console war.

What Does it Mean for Gamers?

For gamers, this means more choices, diverse experiences, and potentially better value. More games could find their way onto Game Pass, offering greater affordability and accessibility. However, concerns about platform exclusivity and homogenization of game design also arise. It’s a complex landscape with both opportunities and challenges for the future.

The Game Isn’t Over:

Microsoft’s studio acquisitions are just one chapter in the evolving story of gaming. It’s a move with clear strategic intent, but the ultimate impact remains to be seen. How these studios integrate, what new games they create, and how the competitive landscape changes are questions that will unfold in the coming years. One thing is certain: the game industry is entering a new era, and Microsoft’s bold moves are putting them at the forefront of this exciting transformation.

[/vc_column_text][/vc_column]

What Others Are Saying:

-

- “Report: Game industry investment, deals to increase in 2024”: Mentions increased M&A activity but also the shift towards “PC-first and cross-platform” projects, suggesting investors are being selective. (Axios)

- “The current state of games investment”: Highlights the changing investment landscape due to the pandemic and economic uncertainty, with investors now being more cautious. (GamesIndustry.biz)

- “How to Invest in the Gaming Industry: A Beginner’s Guide”: Emphasizes the importance of considering financial performance, growth prospects, and competition when investing in gaming stocks. (Medium)

Challenges:

-

- High Risk, Low Success Rate: Many indie studios fail, making returns uncertain.

- Long Development Times: Waiting years for a potential return hinders investor patience.

- Limited Data & Transparency: Assessing indie studios’ potential can be difficult.

- Competition: Crowded market with established players and other indies vying for attention.

- Funding Gaps: Securing enough funding for development and marketing is tough.

Potential Examples of Increased M&A Activity:

-

- Microsoft acquiring smaller studios like Zenimax Media (parent company of Bethesda) and Double Fine. These acquisitions bolstered Microsoft’s Game Pass library and development capabilities.

- Sony Interactive Entertainment investing in Haven Studios, a new studio established by industry veterans. This strategic partnership expands Sony’s first-party development potential.

- Embracer Group, known for acquiring numerous studios, continuing its trend in 2024. While specific targets are unknown, they could be smaller studios with valuable intellectual property or specific development expertise.

Read Better:

Venture Capital Investment in the Gaming Industry: Who’s Investing and At What Stage?

Navigating the Challenge of High Development Costs in the Gaming Industry

Potential Examples of PC-First/Cross-Platform Projects:

-

- Indie success stories like Hades and Stardew Valley, initially launched on PC, later finding success on consoles. This demonstrates the potential for PC-first titles to reach a wider audience.

- AAA titles like Death Stranding and Horizon Zero Dawn receiving PC ports following their initial PlayStation debuts. This shows developers recognizing the growing PC market and adapting their release strategies.

- Games leveraging cloud streaming services like Google Stadia or GeForce Now to offer cross-platform accessibility. This technology allows developers to target more devices without significant porting burdens.

Global Gaming Report 2023:

-

- A record $86B in disclosed value for closed deals and over $20B in 960 announced deals during 2023.

- 163 M&A deals were announced during 2023 with over $10.5B in disclosed deal value.

- Savvy Games Group/PIF’s acquisition of Scopely for $4.9B led the chart and Kahoot’s acquisition by Goldman Sachs consortium ($1.7B) and Techland’s majority acquisition by Tencent ($1.6B) were the only other $B+ deals during the year.

-

- Over $3.5B was raised in 750+ financing rounds of private companies, comparable to the $3.4B raised in 2020 (excluding the large Epic Games deal).

- Mobile was the most active segment (168), followed by blockchain (159) and platform/tools (143). Top financings were VSPO ($265M), Candivore ($100M) and Second Dinner ($100M).

-

- The most active VCs in early to late stage included Bitkraft, Andreessen Horowitz, Play Ventures and Griffin Gaming while the most active seed stage VCs were Goodwater Capital, 1Up Ventures, Global Gaming Report 2023

- TOP 10 ANNOUNCEDDEALS

Microsoft Goes on a Studio Spree: How Acquisitions are Shaping the Future of Gaming

The gaming industry is witnessing a power shift, orchestrated by none other than Microsoft. Their recent acquisition spree, targeting studios like Zenimax Media (Bethesda) and Double Fine, signifies a bold new strategy with far-reaching implications for the future of gaming. Let’s delve into the why and how of this exciting development.

The Power of Game Pass:

Microsoft’s Game Pass subscription service has become a game-changer. Offering access to a vast library of titles for a monthly fee, it’s revolutionizing how players access and discover games. Acquiring studios like Bethesda bolsters this library with iconic franchises like Fallout, Elder Scrolls, and Doom, instantly making Game Pass even more attractive.

More Than Just Games:

But it’s not just about adding popular titles. Microsoft is acquiring studios with proven talent and creative vision. Double Fine, known for quirky yet critically acclaimed games like Psychonauts, brings a unique voice and development expertise to the table. These acquisitions strengthen Microsoft’s internal development capabilities, allowing them to diversify their offerings and cater to a wider range of player preferences.

Building an Ecosystem:

Microsoft isn’t just acquiring studios; they’re building an ecosystem. By bringing together diverse talents and franchises under one roof, they create a synergy that benefits both developers and players. Imagine playing a new Double Fine game with the technical prowess of Microsoft studios, or exploring a post-apocalyptic wasteland in Fallout with the innovative gameplay mechanics of a smaller studio. The possibilities are exciting.

The Competitive Landscape:

Microsoft’s move isn’t happening in a vacuum. Sony, their main competitor, also boasts a strong lineup of first-party studios and successful exclusives. This acquisition spree can be seen as a strategic response, aiming to solidify Microsoft’s position in the ongoing console war.

What Does it Mean for Gamers?

For gamers, this means more choices, diverse experiences, and potentially better value. More games could find their way onto Game Pass, offering greater affordability and accessibility. However, concerns about platform exclusivity and homogenization of game design also arise. It’s a complex landscape with both opportunities and challenges for the future.

The Game Isn’t Over:

Microsoft’s studio acquisitions are just one chapter in the evolving story of gaming. It’s a move with clear strategic intent, but the ultimate impact remains to be seen. How these studios integrate, what new games they create, and how the competitive landscape changes are questions that will unfold in the coming years. One thing is certain: the game industry is entering a new era, and Microsoft’s bold moves are putting them at the forefront of this exciting transformation.

[/vc_column_text][/vc_column]